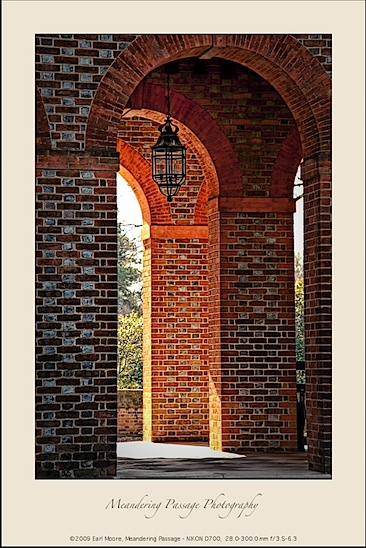

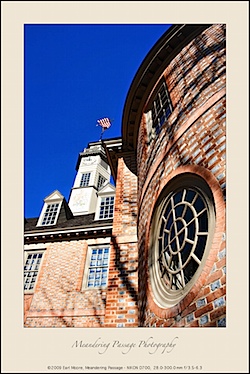

Photos: Colonial Capital building, Archways and Clock Tower – Colonial Williamsburg, VA

Photos: Colonial Capital building, Archways and Clock Tower – Colonial Williamsburg, VA

I doubt anyone has escaped the current economy downturn–either first hand experience or knowing someone who’s been affected.

For sure anyone with a 401K retirement account has seen their funds shrink at an alarming rate and those already retired, living off a fixed interest income from investments or home equity, must be terrified. Even the very rich, although not suffering, have lost millions on the stock market and investment funds.

I’ve been following discussions concerning the purposed stimulus bill, up for vote in the U.S. Senate this week, and it’s evident while everyone agrees something needs to be done no one knows absolutely how to fix it. The problems are huge with so many variables you can’t get your mind around it. Also due to its complexity, applying pressure in one area may cause unexpected negative reactions in another.

As an observer it’s hard to know where the truth lies in what you hear–having to run everything said in Washington through a political bias (BS) filter.

The situation may even be worst then we know. Some are saying we’re heading for a depression or that things will continue to get worst until at least 2010 or longer.

The situation may even be worst then we know. Some are saying we’re heading for a depression or that things will continue to get worst until at least 2010 or longer.

I don’t have the knowledge or experience to make an accurate judgement, but I do think we’ve reached a major turning point for the American lifestyle, a new paradigm. With the collapse of the housing bubble and the associated unsustainable housing appreciation rates, a large percentage of America’s middle class “savings” disappeared along with consumer confidence.

Personal debts are no longer covered by home equity and home appreciation. People are now trying to lower personal debt and increase savings or often simply trying to get by without spending money they no longer have.

Many of the Banks, who for so long posted record profits, are struggling to stay afloat and are being propped up with federal money which from the consumers perspective seems to be going into “black holes.” Money which we as a country are borrowing and will have to eventually pay back with interest!

There will also be future pressures, initially against recovery, as we come to terms with a new world order of global economies and energy requirements. As I said, “huge with so many variables you can’t get your mind around it.”

I don’t know we’ll ever get back to the lifestyle of the last 20 years and it would be better if in some ways we didn’t. That lifestyle got us where we are today and any long term recovery should include planning a better way to define the good life.

Good thoughts, Earl. I think that we did need a wake-up call. I don’t think that an economy can grow forever at that rate that we were growing. There has to be a period of quiescence. Unfortunately, we peaked out and are moving in the opposite direction.

I like some of the things that the president is recommending. I think that any company who takes bail-out money MUST change their ways, cap their salaries, and PAY BACK the loan. It should be a loan, not a grant or gift, a loan to get them by in the lean times.